Market Trend Summary

Bitcoin prices faced a liquidity crisis in June due to geopolitical black swan events but rebounded from late June to early July driven by institutional capital, reaching new all-time highs. In the short term, focus should remain on whether ETF inflows persist, along with key inflation data and policy signals (July 15 CPI, July 30 FOMC). A drop below the psychological $110,000 level could trigger a pullback to the $104,000-$107,000 support range.

Key Supporting Evidence

“Institutional Slow Bull”

Bitcoin spot ETF inflows drove prices to record highs in July. On July 11, Bitcoin ETFs recorded a single-day net inflow of $1.188 billion, the highest in 2025. Additionally, corporate BTC purchases surpassed ETF inflows for the first time in Q2 2025. With accelerating corporate adoption and the anticipated passage of the Singapore Bill by the U.S. Congress, investors broadly expect Bitcoin to set new highs this year. However, a single-day ETF net outflow exceeding $300 million could signal a correction.

Seasonal Effect

Bitcoin’s Q2 2025 return of 29.74% exceeded the historical Q2 average (27.11%). July’s average Bitcoin return stands at 7.7% (vs. SPY +3.3%, VXX -10.5%), with Q3 typically being the weakest quarter for crypto.

Mining Costs

The current average mining cost is $87,000, with a price-to-cost ratio of 0.80 (the lowest in 2025; "lower costs, higher prices"). Miner pricing influence is waning, while institutional demand (via ETF inflows) increasingly stabilizes prices. Bitcoin’s valuation remains reasonably elevated but not yet bubbly. If the price-to-cost ratio falls below 0.65, the market may enter a speculative phase.

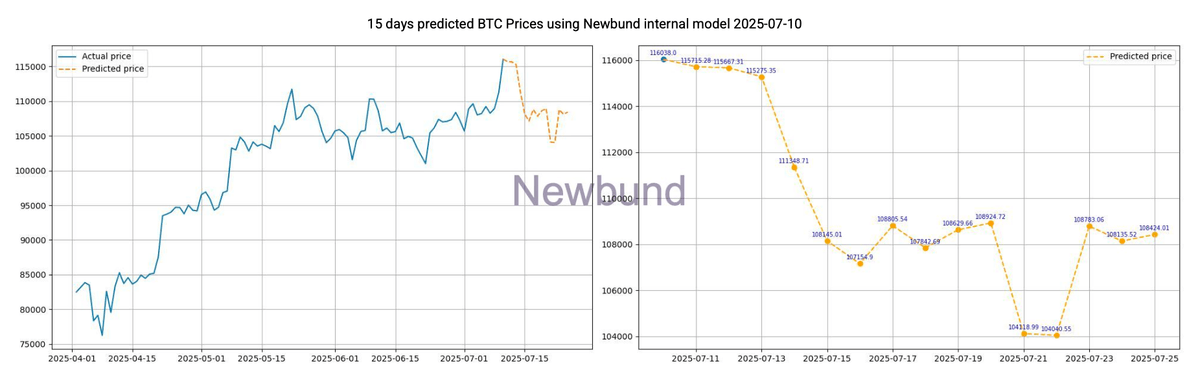

BTC Price Forecast Model

This quantitative model integrates cross-asset analysis (e.g., Treasury bonds, gold, S&P 500 VIX) with BTC’s historical trends to project a 15-day price trajectory (July 10 – July 25).

Projected Prices

Cross-Asset Performance (June 2025)

U.S. Treasury Yields:

10-year yield: Dropped from 4.627% in late May to 4.23% by June-end (-8.6% MoM), hitting 2-month low.

30-year yield: Declined to 4.95% from May's peak (5.15%), driven by dovish Fed signals (Powell/Waller hinting at "earlier cuts if inflation cools") - September rate cut probability now 74%.

Gold: Opened at $3,298.18/oz, closed at $3,302.80 (+0.14%), with a 6.2% swing ($3,247.87–$3,451.14).

BTC: Rose from ~$105,000 to a record $112,000 (All time high), then settled at ~$107,000, up 1.9% for June. Catalysts: FTX creditor distributions ($5B injection), U.S. GENIUS Act and Hong Kong's stablecoin regulations.

S&P 500 & VIX: The S&P 500 rallied 4.96% (5,911.69→6,204.95). Tech mega-caps (NVIDIA's $4T market cap contributing 35% of gains) and economic resilience (initial jobless claims dropping to 227K, a 7-week low) fueled the advance. Buyback activity surged with daily trading volume up 29% YoY ahead of blackout periods.

Forward-looking Risks:

U.S. Treasuries: Trump's "Beautiful Big Bill" may worsen fiscal deficits, sustaining long-bond selling pressure.

Gold: Long-term bullish (central bank demand), but near-term volatility expected.

Bitcoin: Policy catalysts + liquidity inflows could drive new highs.